Easypaisa Karobar Karachi and Lahore

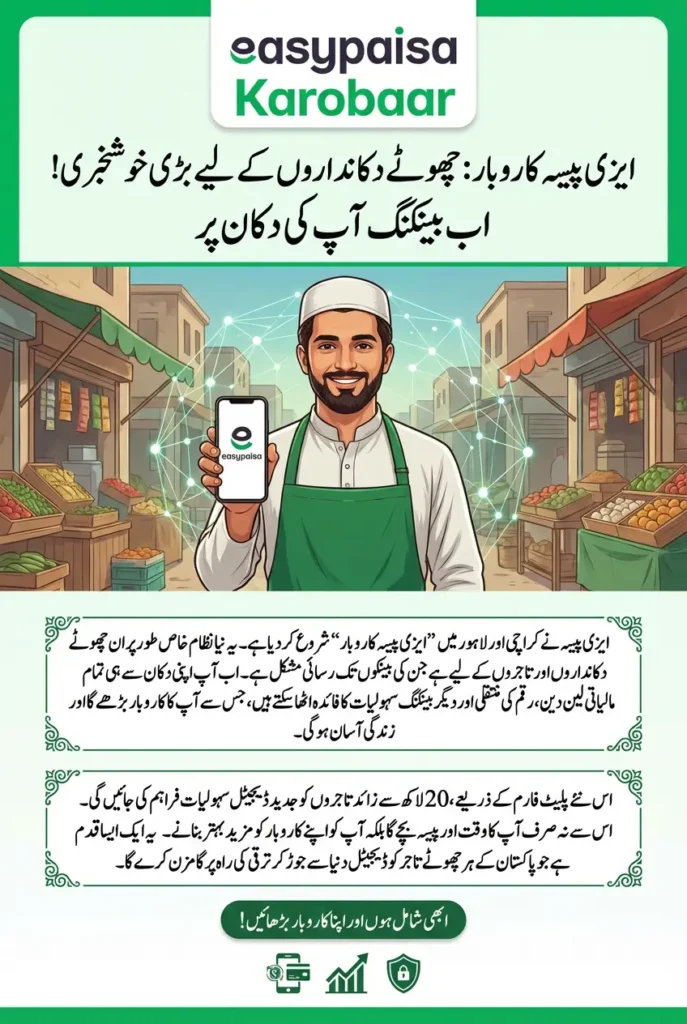

Easypaisa Karobar Karachi and Lahore: Easypaisa has officially launched its innovative platform, Easypaisa Karobar, across Karachi and Lahore in 2026. This platform is designed to provide banking and financial facilities to over 2 million retail merchants across Pakistan, many of whom have limited access to traditional banking services. The launch events were attended by senior executives from Telenor Bank/Easypaisa, fintech companies, FMCG representatives, and distribution houses, signaling strong industry collaboration.

The introduction of Easypaisa Karobar marks a significant step toward modernizing financial access for small and medium-sized businesses. By bridging the gap between digital banking and retail merchants, the platform is expected to create measurable improvements in business operations and financial inclusion.

- Launch cities: Karachi and Lahore

- Target audience: 2 million retail merchants

- Focus on providing banking services beyond conventional banks

How to Check BISP 8171 Payment Status Online and via SMS in 2025

Key Figures at the Easypaisa Karobar Launch Events

The Karachi event was inaugurated by Jahanzab Khan, President and CEO of TMB/Easypaisa, who addressed the participants and discussed the evolving fintech landscape in Pakistan. He emphasized that partnerships like Easypaisa Karobar play a crucial role in fostering a financially inclusive society, benefiting both businesses and individuals.

Shahzad Khan, Head of Channels, Corporate and Product Lending at Easypaisa, provided insights into Pakistan’s retail market, highlighting the importance of digital innovation for merchant success. Senior leadership and industry representatives from various sectors attended the events, demonstrating widespread support for the initiative.

- Jahanzab Khan, CEO of TMB/Easypaisa, inaugurated the event

- Shahzad Khan discussed retail market insights

- Industry leaders and fintech representatives attended

Benazir Kafalat Program 2025: Check CNIC Online and Apply for Rs. 13,500

Easypaisa Karobar’s Role in Financial Inclusion

Easypaisa Karobar is specifically designed to serve retail merchants who are underserved by traditional banks. By offering digital banking facilities and innovative financial tools, the platform empowers small business owners to manage transactions efficiently and expand their operations.

The platform also fosters financial inclusion by providing merchants access to previously unavailable services, helping them participate fully in Pakistan’s growing digital economy. Easypaisa Karobar is expected to serve as a model for similar initiatives across the country.

- Provides banking access to unbanked merchants

- Supports digital transactions and financial management

- Promotes financial inclusion nationwide

BISP Digital Wallet 2025: How to Register JazzCash, Easypaisa,

Benefits for Retail Merchants Across Pakistan

Easypaisa Karobar offers multiple benefits for retail merchants, including access to secure banking channels, real-time transaction processing, and tools for managing business finances. Merchants can now integrate digital solutions into their daily operations, improving efficiency and business growth.

In addition to operational support, Easypaisa Karobar enables retailers to participate in a broader financial ecosystem, opening opportunities for partnerships and collaborations with other businesses and fintech solutions. This platform empowers merchants to compete effectively in both local and national markets.

- Access to secure and convenient banking channels

- Real-time transaction processing

- Tools for financial management and business growth

Honda CD 70 Model 2026 Price and Features Explained

| Benefit | Description |

|---|---|

| Banking Access | Provides digital banking for unbanked merchants |

| Transaction Management | Enables real-time tracking and processing |

| Business Growth | Tools and support for efficient operations |

Industry and Market Impact

Easypaisa Karobar is expected to strengthen the fintech ecosystem in Pakistan by connecting small businesses with digital financial tools. By facilitating easier access to banking and digital payments, the platform encourages the adoption of modern financial practices among retail merchants.

The introduction of Easypaisa Karobar also promotes collaboration between fintech companies, FMCG organizations, and distribution networks, enhancing the overall efficiency of Pakistan’s retail sector. Experts believe this initiative will significantly improve business productivity and contribute to economic growth.

- Enhances fintech adoption in retail businesses

- Promotes collaboration between merchants and financial institutions

- Improves efficiency and productivity in the retail sector

Punjab Land Transfer Ban 2026: Registered Document Mandatory for

Future Outlook and Expansion Plans

Easypaisa Karobar is expected to expand nationwide, aiming to serve millions of retail merchants beyond Karachi and Lahore. The platform will continue to collaborate with fintech and corporate partners to enhance services and ensure broad accessibility for small business owners.

Future updates to Easypaisa Karobar are expected to include additional digital tools, lending options, and partnership programs, reinforcing the platform’s goal of simplifying business banking and promoting financial inclusion across Pakistan.

- Expansion planned to cover more cities nationwide

- Collaboration with additional fintech and corporate partners

- Continuous innovation to improve the merchant banking experience

8171 Payment Collection Center 2025 Complete Guide to Find Your