How to apply for the Asaan Karobar Finance Scheme in Punjab

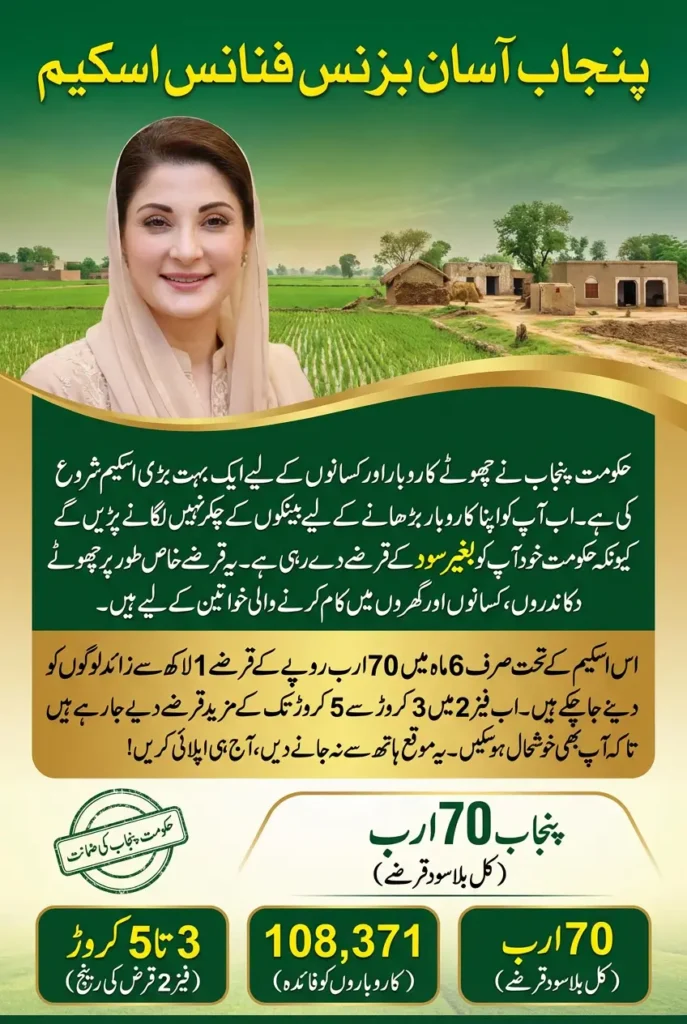

How to apply for the Asaan Karobar Finance Scheme in Punjab: The Asaan Karobar Finance Scheme, Punjab, has emerged as a major relief for people who want to start or expand businesses in the province. In a recent high-level meeting held at Peace House under the chairmanship of the Chief Minister of PunjabMaryam Nawaz, the progress of the second phase was reviewed, and several steps were approved to speed up the process. This scheme focuses on providing interest-free loans to strengthen small and medium businesses across Punjab.

The meeting highlighted that the scheme is not limited to big businesses only but is designed to support SMEs, small traders, cottage industries, vendors, and exporters. With a clear vision of financial inclusion, the provincial government aims to ensure that access to finance becomes easier and faster for deserving business owners.

- Focus on interest-free business loans

- Special support for small traders and SMEs

- Government-backed financial inclusion initiative

Progress Review of the Second Phase of the asaan karobar Finance Scheme

During the meeting, officials shared important figures showing strong progress in the second phase of the Asaan Karobar Finance Scheme in Punjab. Loans worth Rs 22 billion have already been approved, while interest-free loans amounting to Rs 16 billion have been distributed among eligible applicants. These numbers reflect growing trust in the scheme among business communities.

The Provincial Minister for Industries and Commerce assured that chambers of commerce and business associations will be fully informed to increase awareness. This step is expected to improve outreach so that more entrepreneurs can benefit from interest-free financing opportunities.

- Rs 22 billion loans approved in Phase Two

- Rs 16 billion interest-free loans distributed

- Awareness drive through chambers of commerce

New Users Guide: BISP 8171 January Payment Process Explained

Role of the Chief Minister in Expanding Interest-Free Loans

Under the leadership of Chief Minister Maryam Nawaz Sharif, the Easy Business Finance Scheme in Punjab has demonstrated remarkable growth in a short period. In just six months, interest-free loans worth Rs 70 billion have been provided, helping over 108,371 businesses across the province. This support has played a key role in boosting economic activity at the grassroots level.

The Chief Minister emphasized that economic stability starts with strong small businesses. By providing easy access to finance, the government is enabling entrepreneurs to invest confidently, create jobs, and contribute to Punjab’s overall development.

- Rs 70 billion interest-free loans in six months

- More than 108,000 businesses supported

- Strong focus on grassroots economic growth

Easypaisa Karobar 2026: New Platform for Merchants Launched

Loan Amounts and Beneficiaries in Phase Two

In the second phase, the Easy Business Finance Scheme Punjab offers interest-free loans ranging from Rs 30 million to Rs 50 million. These funds are tailored to meet the needs of different business categories, ensuring flexibility and fair access. The scheme is especially beneficial for exporters and cottage industries that often struggle to secure loans from traditional banks.

By targeting a wide range of sectors, the scheme aims to create balanced economic growth. Small vendors and traders, who form the backbone of local markets, are also among the key beneficiaries of this initiative.

- Loan range from Rs 30 million to Rs 50 million

- Support for SMEs, exporters, and cottage industries

- Inclusive approach for small traders and vendors

Key Figures of the Asaan Karobar Finance Scheme, Punjab

The following table highlights the main achievements of the scheme so far, helping readers quickly understand its impact.

| Category | Amount / Number |

|---|---|

| Loans Approved (Phase Two) | Rs 22 Billion |

| Interest-Free Loans Distributed | Rs 16 Billion |

| Total Interest-Free Loans (6 Months) | Rs 70 Billion |

| Businesses Benefited | 108,371 |

Galaxy S26, S26 Plus, and Ultra: Prices, Launch Dates and Features

Who Can Benefit from the asaan karobar Finance Scheme

The scheme is designed to reach a wide audience, ensuring no deserving business is left behind. From urban traders to rural cottage industries, the eligibility criteria focus on genuine business needs rather than complex paperwork.

Another important aspect is transparency in loan distribution. Authorities aim to make the process simple and fair so that applicants can easily understand requirements and timelines.

- SMEs and small traders

- Cottage industries and vendors

- Export-oriented businesses

FAQs

What is the Easy Business Finance Scheme, Punjab?

It is a government-backed initiative that provides interest-free loans to support small and medium businesses across Punjab.

How much loan can be obtained under Phase Two?

Eligible businesses can receive interest-free loans ranging from Rs 30 million to Rs 50 million.

How many businesses have benefited so far?

More than 108,371 businesses have received financial support under the scheme within six months.

Are these loans interest-free?

Yes, all loans provided under this scheme are completely interest-free to support business growth.

Who is eligible for this scheme?

SMEs, small traders, cottage industries, vendors, and exporters operating in Punjab can apply.

Punjab Land Transfer Ban 2026: Registered Document Mandatory for